What is Line 15000 Tax Return (formerly Line 150) in Canada?

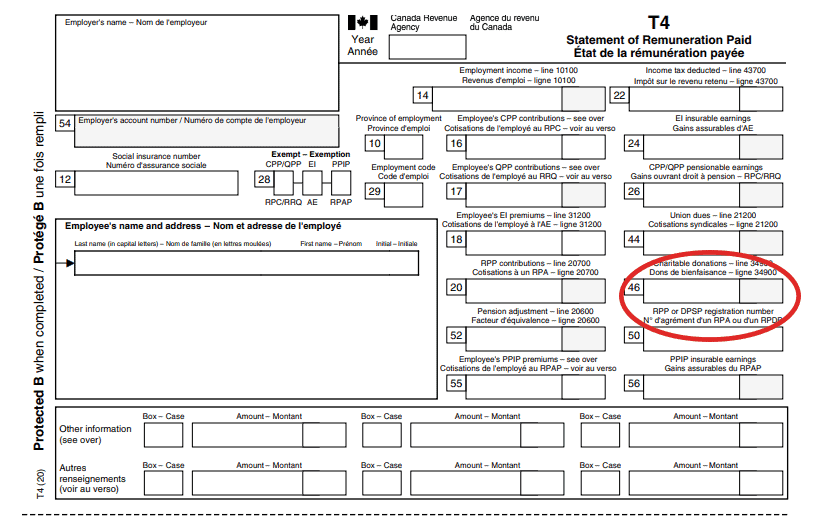

Where Can You Find Line 10100 On Your Tax Return? If you look at a completed federal tax return from the year 2019 or later, Line 10100 should be the first line located under "Step 2 - Total Income", which is normally on Page 3 of your T1 - Income Tax and Benefit Return (also called a T1 General Form).

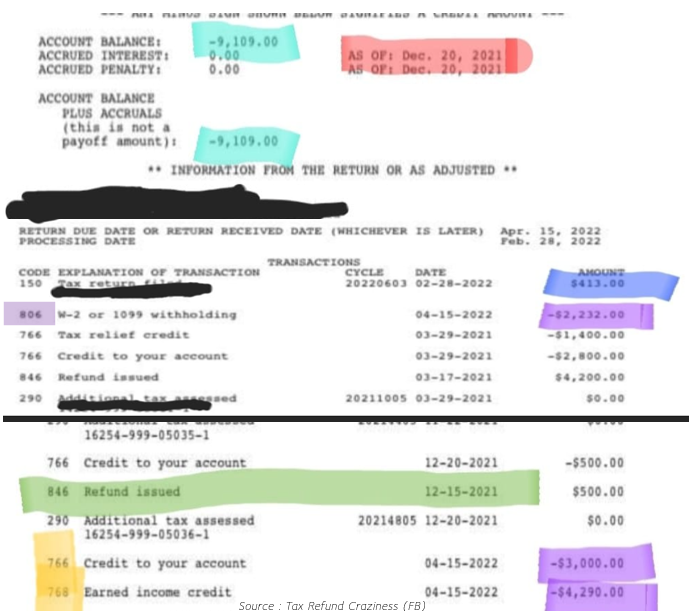

IRS Tax Return 2021 Where is Your Tax Refund 2021? How to Track Your

Simply put, Line 10100 captures the employment income on your Canadian tax returns. Employment income is usually shown in box 14 of the T4 tax slips you received from your employer (s). Salaries, commissions, wages, gratuities, bonuses, and tips are a few examples of employment income that could be reported on box 14.

How to claim the stimulus money on your tax return

In conclusion, Line 10100 on your tax return represents your total income, which is the starting point for calculating your tax liability and eligibility for various tax credits and benefits. It's crucial to report your income accurately to avoid issues with the CRA and to ensure you're taking advantage of all available tax benefits. By.

What is Line 10100 Tax Return (Formerly Line 101) in Canada?

Line 10100 is the sum of all the amounts recorded in box 14 of your T4 slips, representing your job income. Employment income is reported on form 10100, although it may not be the whole of your take-home pay. You may locate this sum on your tax return down below line 15000.

HMRC 2021 Paper Tax Return Form

Elections Canada Foreign property Step 2 - Total income Amounts that are not reported or taxed Report foreign income and other foreign amounts Line 10100 - Employment income Line 10400 - Other employment income Line 11300 - Old age security (OAS) pension Line 11400 - CPP or QPP benefits Line 11500 - Other pensions and superannuation

What is line 10100 and 10400 on tax return? YouTube

COVID Tax Tip 2022-16, January 31, 2022. IRS Free File, available only through IRS.gov, is now accepting 2021 tax returns. IRS Free File is available to any person or family with adjusted gross income of $73,000 or less in 2021. The fastest way to get a refund is by filing and accurate return electronically and selecting direct deposit.

What Your IRS Transcript Can Tell You About Your 2022 IRS Tax Return

Direct Deposit. Reduced Refunds. Fix/Correct a Return. You can check the status of your 2023 income tax refund 24 hours after e-filing. Please allow 3 or 4 days after e-filing your 2021 and 2022 tax year returns. If you mailed a return, please allow 4 weeks before checking your status.

How do I find a line number from my tax return? Help Centre

Line 10100 on your Income Tax and Benefit Return form represents your employment income. If you had to submit a tax return before the tax year 2019, this would have been known as line 101.

Tax Information United Way of KFL&A

Table of Contents show What is Line 10100 On Tax Return? Line 10100 is the line that captures the employment income on your Canadian tax returns. Employment income are usually shown in box 14 of the T4 tax slips you received from your employer (s).

What Is Line 10100 on Your Tax Return?

2021 US Tax Calculation for 2022 Tax Return: $10.1k Salary Example If you were looking for the $10.1k Salary After Tax Example for your 2021 Tax Return. it's here Brace yourselves for a surprise!

What Is Line 10100 On Tax Return? Tax Help RightFit Advisors

Key Takeaways Line 10100 is the space on your Canadian tax returns where you enter all of the employment income earned in the year. You must report your total income sources including your wage, salary, tips, commissions, bonuses, gratuities, and honoraria.

What is Line 10100 on Tax Return (formerly 101) Notice of Assessment

Line 10100 is located in the "Income" section of your tax return, specifically under the "Total Income" heading. It's here where you'll report the income you've earned from employment over the tax year.

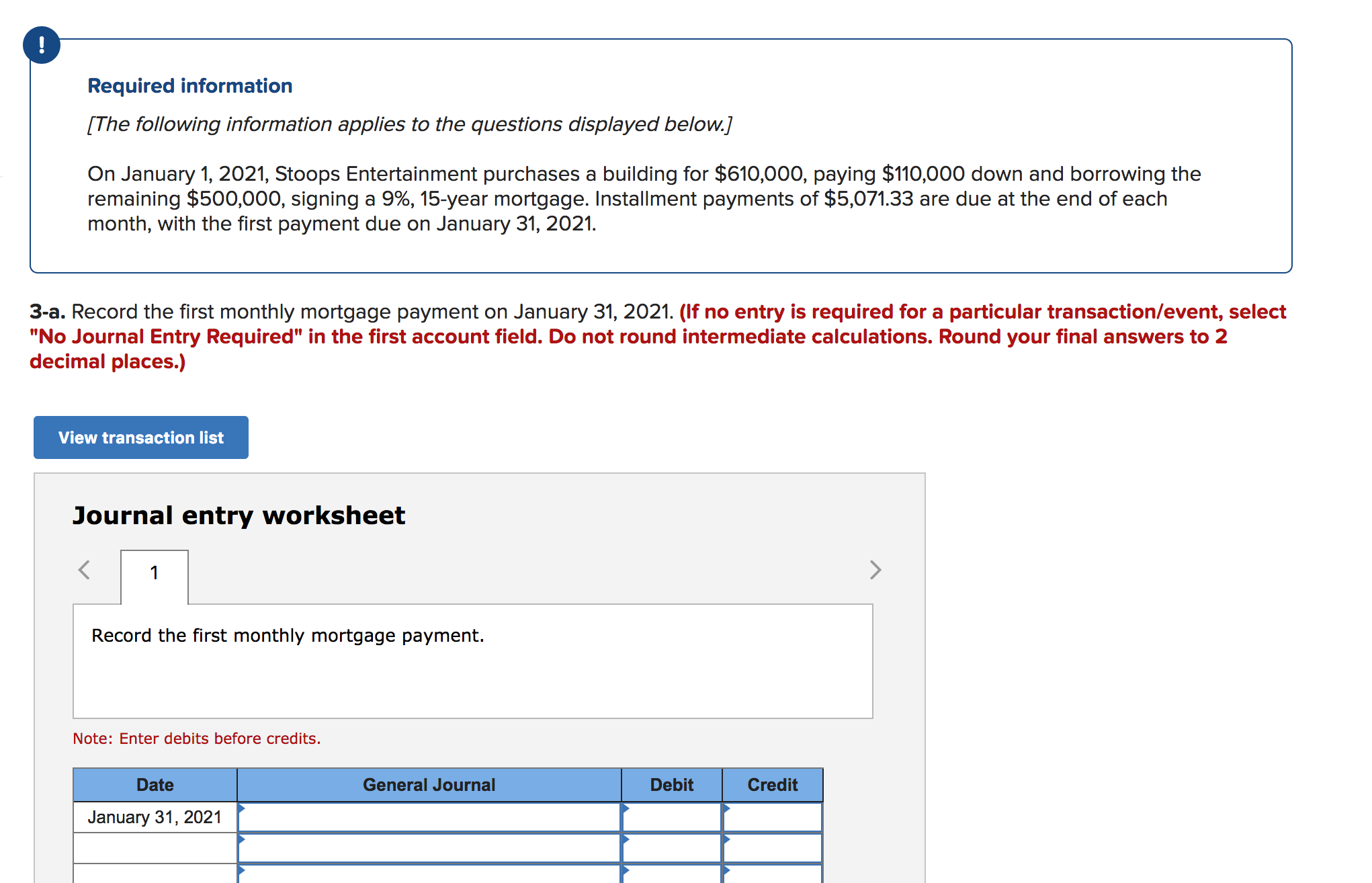

8+ a fully amortizing mortgage loan is made for 80000 MiteshKimmy

Line 10100 - Employment Income: From Box 14 on your T4 - Statement of Remuneration slips. Line 10400 - Employment Income Not Reported on a T4 Slip: Such as tips and gratuities, or casual income not reported on a T4.

Check Withholdings now to make the most of your 2021 tax refund

The tax line 10100 is where a Canadian resident would declare their employment income. This amount will include: For the upcoming tax season, your employer/ employers will provide you a T4 slip. In this slip, there is a "box 14" that reports all your employment income. The total amount shown in this "box 14" in the T4 slip is shown in line 10100.

What is Line 10100 on Tax Return (formerly 101) Notice of Assessment

Line 10100 is one of the most important lines on your tax return. It's where you enter all the employment income earned for the year. If you are filing a simple tax return and your total income was on one t4, then you just enter that amount. If your return is a little more complex and you have more than one source of income, you would need to.

StudioTax Canadian Personal Tax Software tax software

Line 10100 on your tax return represents your employment income from wages and salaries, taxable allowances, and benefits. Your employment income usually shows up on box 14 of your T4 slip. Before 2019, line 10100 was known as line 101.